Overview

US citizens and residents, including those sheltering in the United States, must manage the US tax regime on global income and US reporting rules on foreign accounts, foreign financial assets and controlled foreign corporations.

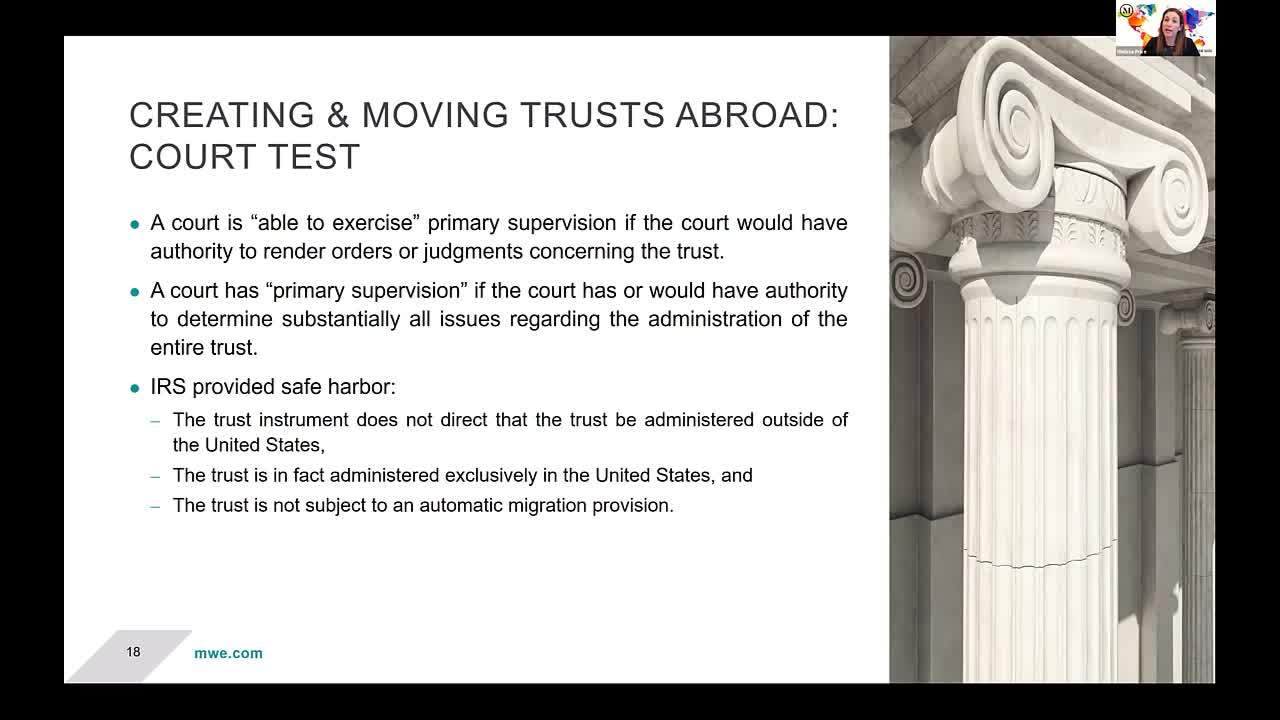

The panel will address these issues and review planning techniques involving tax treaty, expatriation and trust planning for migrating families.

Have a question that you would like us to answer? Click here to submit your query.

STAY AHEAD OF THE CURVE

Interested in receiving articles on similar topics as they are published? Subscribe for timely email updates or contact us to discuss more…